Is this a Bubble or a Buble?

May 6th, 2011 | Uncategorized | No Comments » Every day, I check TechCrunch. It’s sort of a must-do type of thing. First, you have to do it to see what the latest trends are for start-ups and funding. Secondly, if you’re involved in a tech start-up and you don’t read TechCrunch, well, you’re seen as a bit of poseur. And it’s not one of those things where by not doing it you seem even cooler….like not owning a TV. For some reason, if you don’t own a TV. people think you’re really smart. But is that really that smart? T.V. and the internet are the main sources of news and critical information. It’s like going back thousands of years and saying “I don’t fire” and expecting people to really respect you.

Every day, I check TechCrunch. It’s sort of a must-do type of thing. First, you have to do it to see what the latest trends are for start-ups and funding. Secondly, if you’re involved in a tech start-up and you don’t read TechCrunch, well, you’re seen as a bit of poseur. And it’s not one of those things where by not doing it you seem even cooler….like not owning a TV. For some reason, if you don’t own a TV. people think you’re really smart. But is that really that smart? T.V. and the internet are the main sources of news and critical information. It’s like going back thousands of years and saying “I don’t fire” and expecting people to really respect you.

Ok. Back to my original thought. I’m reading TechCrunch and in the last 6 months, at least once a week, there is news of a small startup getting large funding or being acquired by a larger strategic player. For those of us old enough to remember the late 90’s (and who could forget Ace of Base), it’s getting a little scary because it’s feeling like a bubble. Irrational exuberance. High Valuations. People are losing their F&^%$#*! Minds.

But is this latest round of investment and acquisition really a bubble? Or is it logically investing. I mean, where else should you put your money? Real Estate? Corporate Debt? Blue-Chip Stocks (with 4% growth). Recent technology investments are based on profitable companies or scalable services that a larger player would rather buy than build.

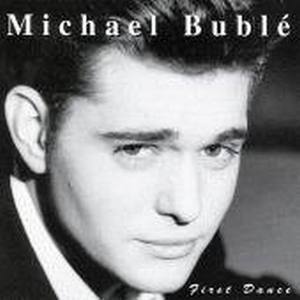

I guess what I’m saying is this seems more like Buble than a Bubble. By that I mean a pitch-perfect time for technology. Also, I just love referencing Michael Buble.